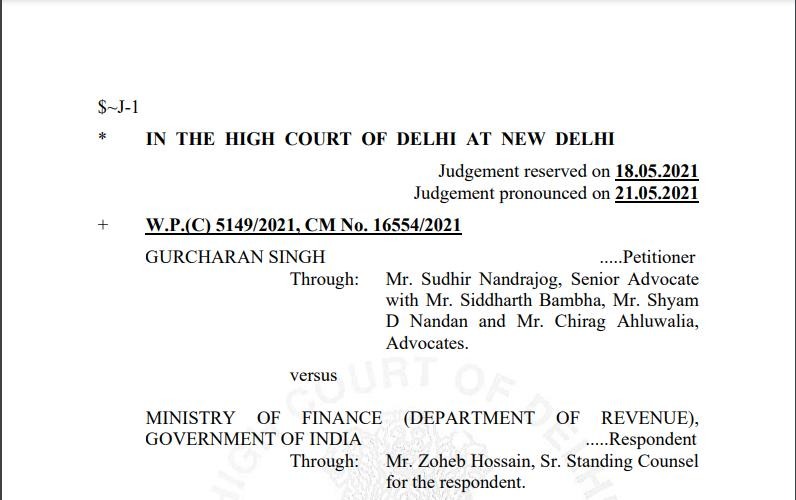

Article on case “Gurcharan Singh Vs Ministry of Finance (Delhi High Court)” CM No. 16554/2021

By- Tanushree Chakraborty

Recommended By- Yukti Rathi

- Gurcharan Singh, 85, filed the petition through his carer and grandson Ankit Sahni. Singh has been infected with COVID-19 whose nephew sent an oxygen generator as a gift from US. The petitioner argued that the imposition of any kind of fee by the State on the import of oxygen/oxygen generators for personal use violates the right to have oxygen, which is part of the right to life under Article 21 of the Indian Constitution.

- The Delhi High Court found that the exclusion of persons from receiving Oxygen Concentrators as presents for personal use without going through a canalizing agency as per government notification dated May 3 is a violation of Article 14 of the Constitution, observing that it is a George Floyd moment for the residents of this nation while saying “I can’t breathe.”

- Issues before the court,

- Is it possible that the State’s conduct of charging IGST on oxygen concentrators that were directly imported by people, although at no cost, without the assistance of a canalising agency violates Article 14 of the Constitution?

- Is it true that Article 21 of the Constitution puts an affirmative responsibility on the State to provide enough resources for safeguarding and preserving the health and well-being of those living under its jurisdiction?

- What, if any, remedy can be provided to the petitioner?

- This writ petition is one of those unusual writ cases in which a notification issued in the context of a tax legislation has been challenged, among other things, under Article 21 of the Constitution.

The fact that the tax is a state exaction is well acknowledged. It is also generally known that its levy and collection do not normally include equity. However, we are currently living in terrible circumstances, and hence the petitioner may have cited Article 21 of the Constitution.

- The development arose as a result of an 85-year-old man’s petition contesting the imposition of IGST on the import of oxygen generators as a gift for personal use into India. The petitioner disputed a notice issued by the Ministry of Finance on May 1, 2021, saying that the oxygen concentrator would be subject to a 12% IGST. It also asked the registrar to release the money lodged with it by the petitioner, as well as any interest collected, as soon as possible.

- When Article 21 is cited in tax, it is an uncommon occurrence. This is a challenging scenario. Why should the state be unconcerned about it?

The Court requested that the order it issued be presented to the Finance Minister of the Government of India. “It’s illogical. How much tax would you collect from individuals? “the Court insisted.

- The tax system on medical-grade oxygen and the instruments required to transport and consume it, like everything else in India, is convoluted. The price of medical-grade oxygen is subject to a 12 percent of goods and service tax i.e., GST. Oxygen concentrators for personal use were subject to a 28 percent GST, which was the highest rate. The petition was filed with the Supreme Court demands the removal of GST on pharmaceuticals such as Remdesivir, Tocilizumab, and Favipiravir, as well as requesting that the government exclude oxygen from GST via the apex court.

- The tax paid on the consumption of goods or the delivery of services is shared 50:50 between the Centre and the state under the Goods and Services Tax (GST).

An Integrated-GST or IGST is taxed on inter-state movement of commodities as well as imports, with the proceeds going to the Centre. Businesses can use the amount paid as IGST to claim credit when making CGST or SGST payments at the time of sale.

- Since US president Joe Biden decided to waive off the IP norms on COVID vaccines, they were as reluctant when other countries approached the world trade organization with a large number of nations. They refused to waive it. And now, common reason has triumphed, as they see that if this continues, it will have an impact on the United States as well.

- The lower IGST rate for concentrator imports for personal use will be in effect until June 30. Earlier this month, the government abolished customs duties on the import of medical grade oxygen, oxygen concentrators, and related equipment.

- Although the announcement giving exemption from IGST qua import of oxygen concentrators via a canalising agency cites the “exceptional circumstances” clause as mentioned in sub-section (2) of Section 25 of the Customs Act, there is no evident reason why the exemption from IGST charge is not extended qua oxygen concentrators imported by people for personal use. While tax exemption is not a right, but rather a characteristic that needs policymakers to consider numerous considerations before providing an exemption- the disparity created between two groups of importers is manifestly unjustified and so violates Article 14 of the Constitution.

- While there is no legal right to seek tax exemption, if the State utilises the provisions of Section 25 of the Customs Act, such delegated legislation can be contested in court. The contested notification is clearly arbitrary, and thereby violates Article 14 of the Constitution. The challenged announcement is unreasonable since there is no discernible difference between the two categories of oxygen concentrator imports. One is provided by the State and its agencies, and the other is provided by the individual as a gift for personal use. As a result, there is a lack of a sufficient deciding principle.” The following decisions are cited in support of these submissions.

a) Union of India vs. N.S. Rathnam & Sons, 10 SCC 681 (2015)

b) Shayara Bano vs. Union of India, 9 SCC 1 (2017)

- Section 3(7) of the customs tariff act, which permits for the imposition of IGST on imported products, sets the ceiling rate at 40%. The valuation provision is included in Sections 3(8) and 3(8A) of the CTA. Section 3(12) gives the authority to exclude, among other things, the IGST charge.

As a result, beginning on July 1, 2017, basic custom duty is charged on imported products under the Customs Act, while IGST is charged under Section 3(7) of the customs tariff act read with Section 5 of the IGST Act.

- Oxygen concentrators would be covered by Entry no. 607A, Tariff Item no. 9804 of the General Exemption no. 190, since the definition of medications in Section 3(b) of the Drugs and Cosmetics Act, 1940 [in short, the Drugs and Cosmetics Act] would include medical equipment intended to cure and prevent human disease. Furthermore, because an oxygen concentrator is unquestionably a life-saving piece of equipment, it should not be subjected to the rigors of certification by authorities, as specified in condition no. 104 against entry no. 607A.

- The Court found that, in most cases, taxes did not involve any component of fairness. However, given the current circumstance, a petitioner before it had cited Article 21 of the Indian Constitution to challenge a levy.

- Thus, the Court held that the State should yield, or at the at least reduce the burden of exactions, during times of war, hunger, floods, epidemics, and pandemics, since such an approach would allow a person to live a life of dignity, which is a feature of Article 21 of the Constitution. It is also noted that oxygen concentrators are now on par with life-saving treatments and treatments hence drew out the best and worst of the individuals. Therefore, insist of collecting taxes and then spending it on relief, government shall focus more on exempting it at the first place.