Finance Minister Nirmala Sitharaman on 23rd July presented the annual budget of the country after the ‘Interim Budget’ which was given on 1st February that came ahead of the Lok Sabha elections 2024. This is the seventh record union budget presented by Nirmala Sitharaman and first Budget by the BJP-led NDA government since it was re-elected in June,2024.

On highlighting the present India’s economic growth our finance minister said that India’s inflation continues to be low, stable and moving towards the 4% target and core inflation currently is 3.1%.

In the interim budget our finance minister stated to focus on 4 major castes, namely ‘Garib’ (poor), ‘Mahila’ (women), ‘Yuva’ (youth) and ‘Annadata’ (farmer). By announcing several schemes like Pradhan Mantri Garib Kalyan Anna Yojana was extended to five years, benefitting more than 80 crore people.

The budget for 2024-2025 is the action plan for the Modi 3.0 government to outline a roadmap towards India’s development in the next five years. Budget focused on provisioning for the agricultural sector, the introduction of schemes related to employment, loan schemes, announcements for financial support to the MSME sector, infrastructural development, and fiscal deficit projection at 4.9% with a commitment to reducing it down to 4.5%.

Prime Minister Narendra Modi praised the Union Budget presented by Nirmala Sitharaman. He said the Budget 2024 will benefit all sections of society and lay the foundation for a development India.

HIGHLIGHTS:-

- The Union Budget 2024-2025 would support schemes for women and girls worth 3 lakh crore.

- Govt. to provide ₹1.48 lakh crore for education, employment, and skill development.

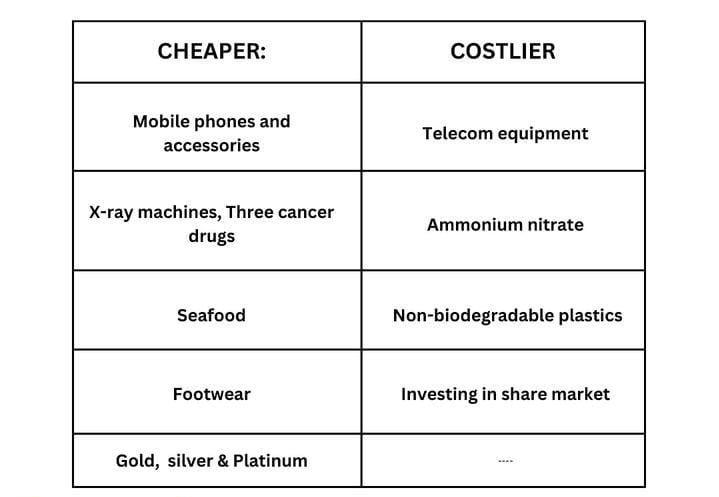

- Government to reduce customs duty on gold, silver to 6%, platinum to 6.4%.

- Internships Opportunities in 500 top firms to 1cr youth in 5 years. ₹5,000 in internship allowance & ₹6,000 in one-time assistance will be given as part of the internship program.

- A Direct Benefit Transfer (DBT) of one month’s salary (up to ₹15,000) will be provided in 3 instalments to first-time employees registered in EPFO.

- Aim to make urban housing more affordable by spending 2.2 lakh crore.

- 100 street foodhubs will be developed in a few locations over the course of 5 years.

- Housing needs of 1 crore urban poor and middle-class families are to be addressed with an investment of ₹10 lakh crore.

- In a move to pave the way for more startup investments in the country, the angel tax will be abolished for all classes of investors.

- Special Packages for Andra Pradesh: ₹15000 crore and Bihar: ₹26000 crore.

- Fiscal Deficit to reduced be reduced below 4.5% of GDP by 2025-26, with further reduction planned.

- Rooftop Solar Scheme-launched to provide 300 units of free electricity every month.

Budget 2024 Focus on 4 major castes(Four-Pillars of Vikshit Bharat)

- Gareeb (Poor)

- Mahilayein (Women)

- Yuva (Youth)

- Annadata (Farmers)

Budget Theme

- Employment

- Skilling

- MSMEs

- Middle Class

9 Priorities for Viksit Bharat :-

- Productivity and resilience in agriculture

- Employment and skilling

- Inclusive Human ReProductivity and resilience in Agriculture

- Manufacturing and Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development

- Next Generation Reforms

#1 Productivity and resilience in Agriculture:

- Raising Productivity & Climate Resilient Varieties.

- Provision of ₹1.52 lakh crore for agriculture and allied sector.

- 1 crore farmers across the country will be initiated into natural farming,

supported by certification and branding in next 2 years. - Vegetable Production: Large Scale Clusters

- 10,000 need-based bio-input resources centers will be established.

- DPI in Agri Infrastructure: Coverage of Farmers and their land in 3 years

- National Co-operation Policy for Co-operative Sector.

#2 Employment and Skilling:

- Prime Minister’s Package: 3 schemes announced under ‘Employment Linked Incentive’

Scheme A: First Timers

-Direct benefit transfer of 1-month salary in 3 installments up to ₹15,000 to first-time employees registered in EPFO.

Scheme B: Job Creation in Manufacturing

-Incentive to be provided directly to both employee and employer as per their EPFO contribution, in the first 4 years employment.

Scheme C: Support to Employers

-Reimbursement to employers up to ₹3,000 per month for 2 years towards their EPFO contribution for each additional employee

- 20 lakh youth will be skilled over a 5-year period.

- Educational Loans: Financial Support up to 10 Lakhs for higher education in domestic intitutions.

#3 Inclusive Human Resource Development and Social Justice:

- Purvodaya: Vikas bhi Virasat bhi: A plan for the all- round development for the eastern region covering Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh.

- Government will also support development of road connectivity projects in Bihar at a total cost of 26,000 crore rupees.

- Government will facilitate special financial support of 15,000 crore rupees for Andhra Pradesh.

- 3 crore additional houses under the PM Awas Yojana in rural and urban areas in the country have been announced.

- ₹3 lakh crore rupees allocated for schemes benefitting women and girls.

- More than 100 branches of India Post Payment Bank will be set up in the North East region.

#4 Manufacturing and Services:

- Credit guarantee scheme for facilitating term loans to MSMEs.

- Limit of Mudra loans will be enhanced to rupees ₹20 lakhs from the current rupees ₹10 lakh limit for entrepreneurs who have repaid previous under the Tarun category.

- Government will facilitate development of investments ready plug and play industrial parks in or near 100 cities.

- Twelve industrial parks under the National Industrial Corridor Development Programme.

#5 Urban Development:

- Government will facilitate development of ‘Cities as Growth Hubs’. This will be achieved through economic and transit planning, and orderly development of peri-urban areas utilizing town planning schemes.

- Under the PM Awas Yojana Urban 2.0, housing needs of 1 crore urban poor and middle class families will be addressed with an investment of ₹10 lakh crore rupees.

- Streets Market: Support for urban haats

#6 Energy Security:

- Nuclear energy is expected to form a very significant part of the energy mix for Viksit Bharat.

- A joint venture between NTPC and BHEL will set up a full scale 800 MW commercial plant using AUSC technology. The goverment will provide the required fiscal support

- PM Surya Ghar Muft Bijli Yojana:1 crore Households obtain free electricity,Up to 300

Units every month, 1.28 crore Registrations and 14lakh applications so far.

#7 Infrastructure:

- Phase 4 of Pradhan Mantri Gram Sadak Yojana(PMGSY) will be launched to provide all-weather connectivity to 25,000 rural habitations which have become eligible in view of their population increase.

- A provision of 1.5 lakh crore rupees for long-term interest free loans has been made this year also to support the states in their resource allocation.

- ₹11.11 lakh crore allocated for capital expenditure.

- Support for development of odisha.

- Assistance for flood management and related projects in Assam,Sikkim & Uttarakhand.

- Development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor modelled on Kashi Vishwanath Temple Corridor

#8 Innovation, Research and Development:

- The government will operationalize the Anusandhan National Research Fund for basic research and prototype development.

- The emphasis is on expanding the space economy by 5 times in the 10 years, a venture capital fund of ₹1,000 crore rupees will be set up.

#9 Next Generation Reforms:

- Technology to speed up digitalization of economy.

- Jan Vishwas Bill 2.0 to improve Ease of Doing Business

- States will be incentivized for land related reforms and actions within the next 3 years through appropriate fiscal support.

- Land-related reforms and actions in rural areas to cover land administration and planning. In urban areas, it will cover urban planning, usage and building bylaws.

What Get Cheaper And What Get Costlier :-

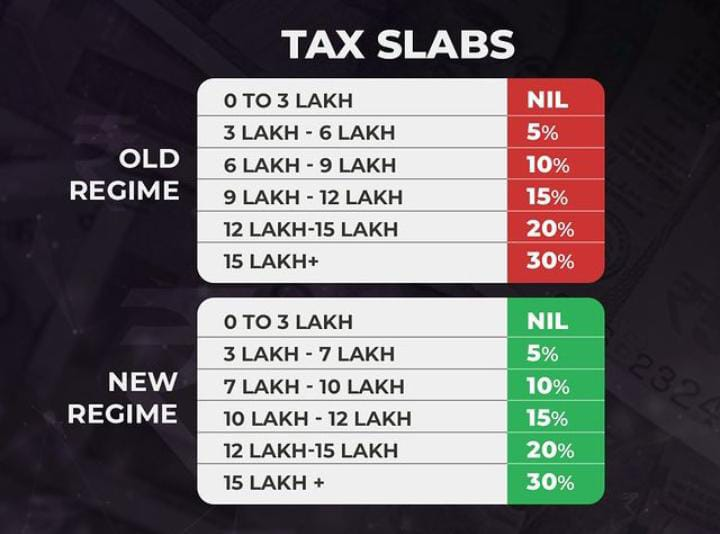

Major Tax Highlights :-

Major Tax Highlights :-

- Capital Gains Exemption raised to ₹1.25 lakh annually for Listed Financial Assets.

- Short-Term Capital Gains Tax revised to 20% for Specified Financial Assets.

- Long-Term Capital Gains Tax revised to 12.5%.

- Standard Deduction for Salaried Employees increased from ₹50,000 to ₹75,000 under New Tax Regime.

- Deduction on family pension for pensioners increased from ₹15,000 to ₹25,000

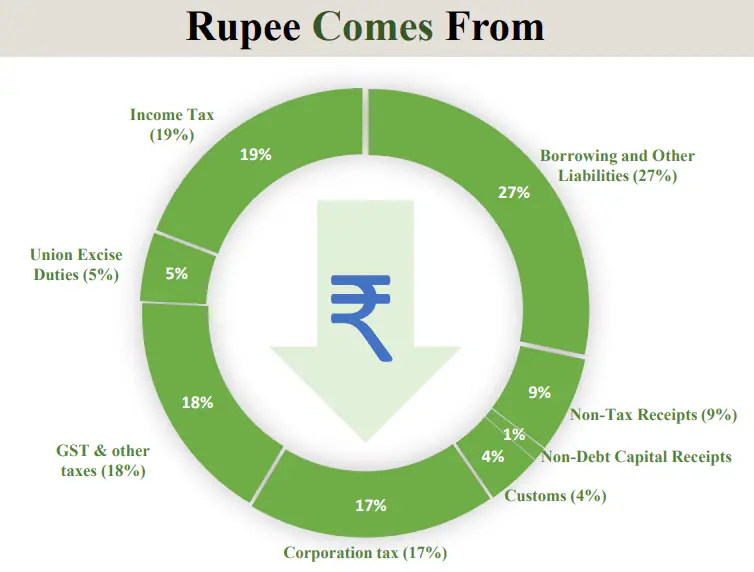

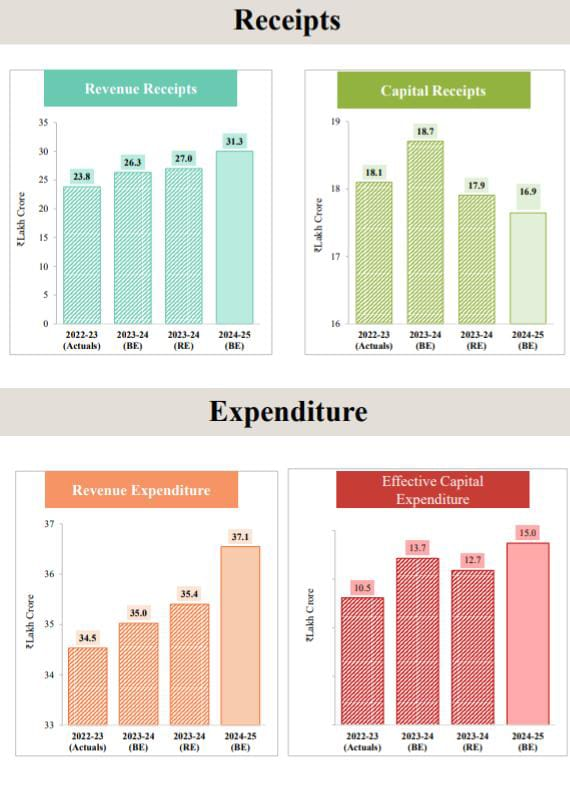

Revenue Streams of Government :-

Source: Union Budget Document

Source: Union Budget Document

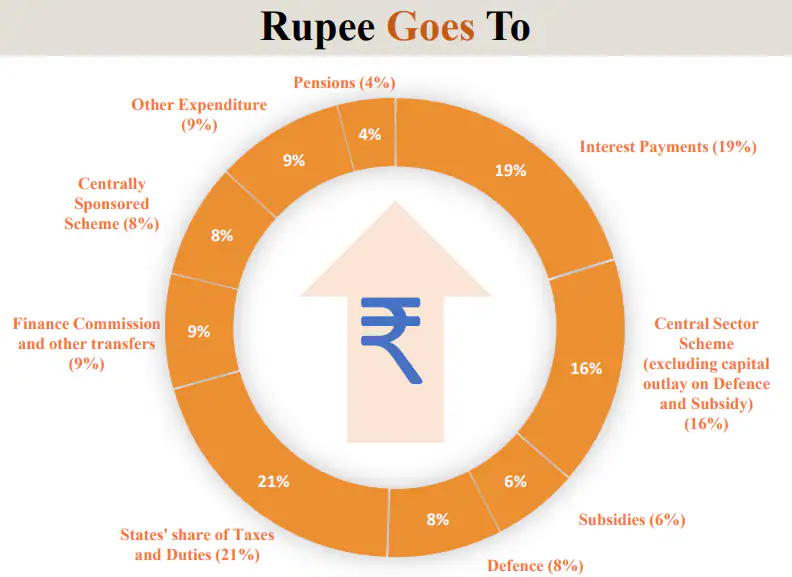

Government Spending :-

Source: Union Budget Document

Source: Union Budget Document

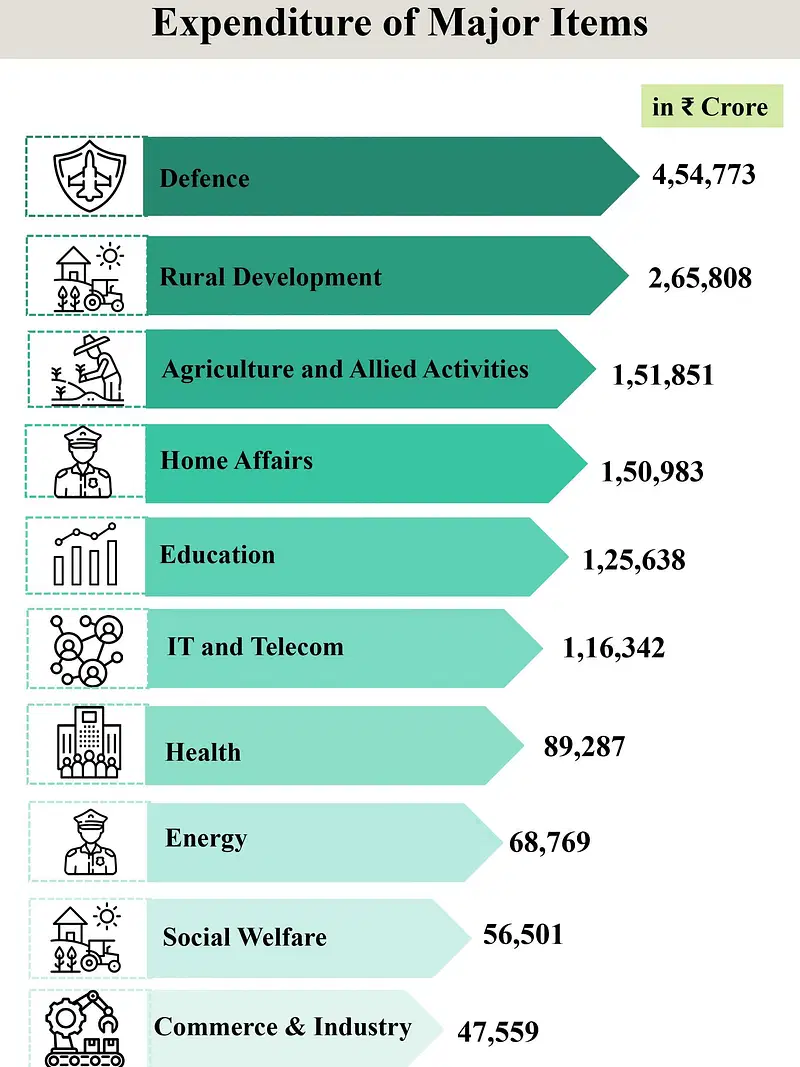

Ministry – Wise Allocation :-

Source: Union Budget Document

Source: Union Budget Document

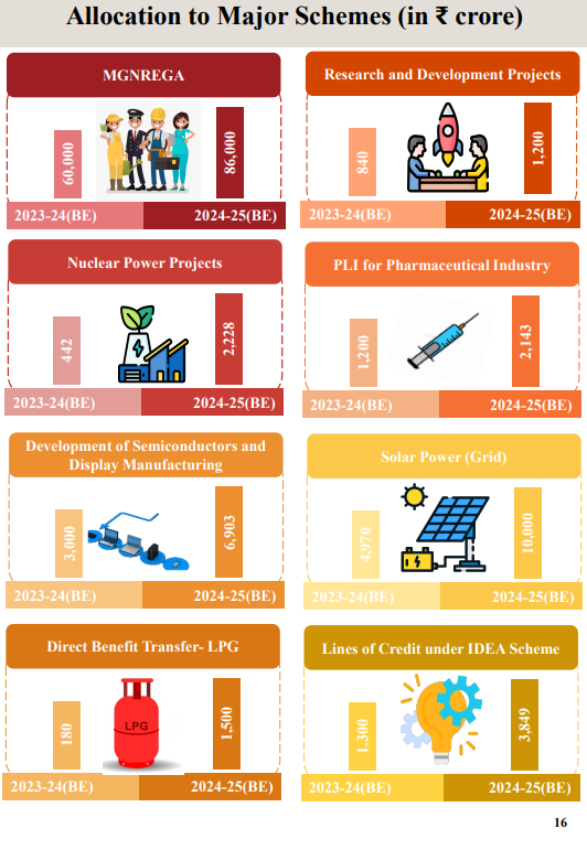

Allocation to Major Schemes (in ₹ crore) :-

Source: Union Budget Document

Source: Union Budget Document

Budget at a Glance :-

Source: Union Budget Document

Source: Union Budget Document

In conclusion, the Annual Budget 2024-25 reflects the idea of focusing on the grounded fields and mainly empowering the youth and women for ‘Viksit Bharat’. Budget gives infrastructural development and skill development for employment generation which is being praised as it covers all the sections of the society.